When your mortgage is underwater, or upside-down, the amount you owe on the mortgage loan is more than the property’s current market value. So, of course, it’s best to ride out the changing real estate market and stay in the home for several years to allow equity to build. But, what if that is not an option? It is not always possible to ride out the equity wave and many motivating factors lead homeowners to sell sooner than expected. Just this past week a friend’s husband was suddenly offered an amazing job opportunity out of state which prompted the unexpected relocation of their entire family. Others are looking to move long distances to be nearer to family, or are faced with difficulty making payments. Life is already stressful and selling your home can be even more so. And expensive. And time-consuming. For most of us, it is the largest financial decision of your life, and naturally, you want to make the best deal possible, no matter circumstances.

Understandably, sellers feel overwhelmed when faced with a mortgage underwater. You may think there is no way out of the hole. The distance to the surface is to far and the financial loss too great. The key is understanding your choices so you can move confidently forward and make decisions. A few options are available if you’re facing difficulty making payments. If you should find yourself with a Arlington mortgage underwater, read on as we explore what you can do about it.

Lender Options

One option for those with a Arlington mortgage underwater is to discuss the options your lender can provide. Loan modification, short sale, or submitting a deed in lieu of foreclosure are viable options that many lenders offer. It’s best to enter any of these processes with your eyes wide open to the realities of what a lender will require of you and get a clear understanding of how your efforts will affect the outcome. Educate yourself on the negative consequences, including the effect on your credit score, and why you should avoid foreclosure. Professional buyers, like those at O&L Properties LLC, can help you understand your options and weigh the pros and cons of each course of action. At O&L Properties LLC, we highly value total transparency because we want what is best for the seller, even if that means we don’t to buy the house.

Direct Sale

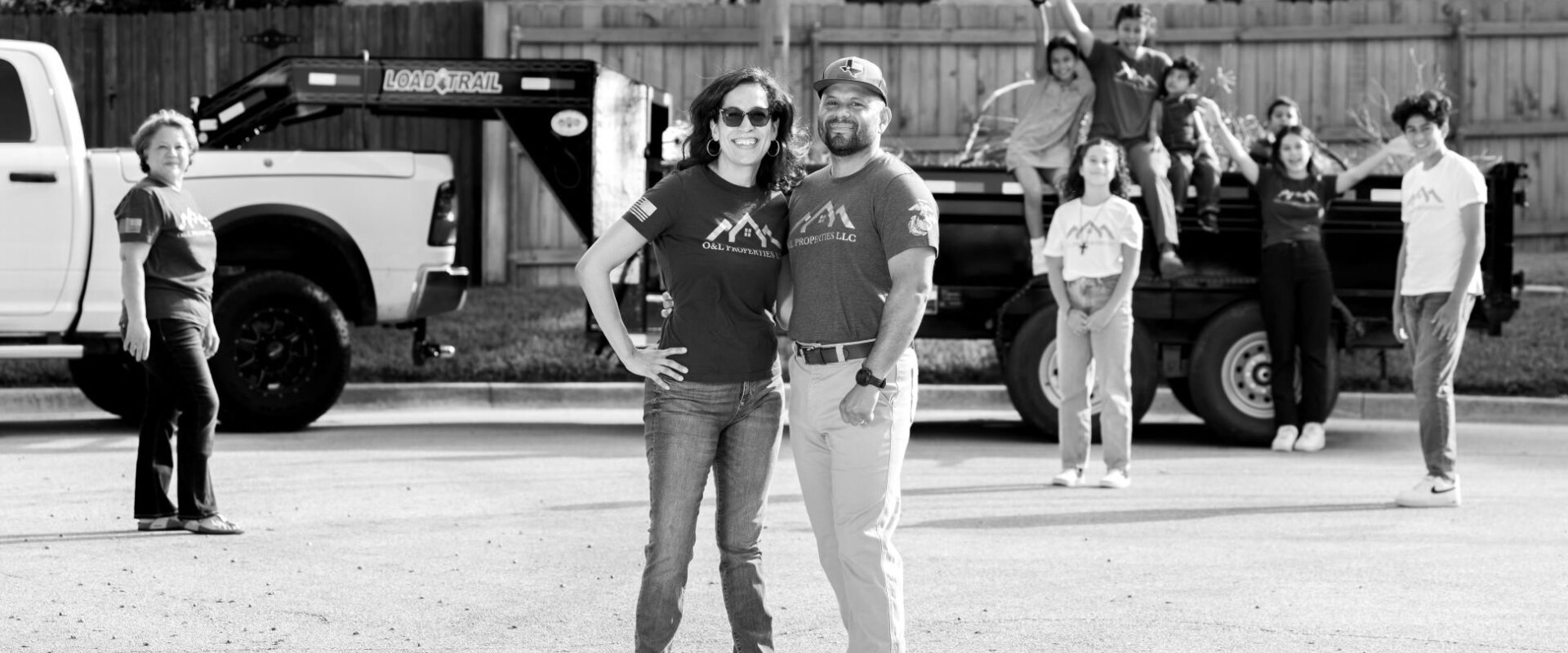

Or, if you have a Arlington mortgage underwater, selling directly to O&L Properties LLC means you bypass the lender paperwork, and the acrobatic acts of jumping through hoops to meet deadlines and satisfy the lender. When you make a direct sale, you also don’t have to worry aabout spending cash out of pocket for repairs or pay for costly marketing expenses and real estate commissions. You’re under enough stress, right?! At O&L Properties LLC, we buy houses in as-is condition and take on ALL the risks. At O&L Properties LLC, we never charge commissions and NO hidden fees await you at closing. You won’t even pay closing costs. We are a family team of local pros who work quickly and efficiently and provide Arlington sellers with a mortgage underwater a guaranteed speedy closing date. Talk to us at O&L Properties LLC about what timeframe works best with your needs.

A direct sale to O&L Properties LLC is the best way to sell if you have a Arlington mortgage underwater, or ‘upside-down’ mortgage. We make selling directly easy for sellers at O&L Properties LLC with straightforward contracts, and a quick, fair offer. We’re your neighbors, really! We know our market. We live here, and work alongside you here in Arlington, and we want you to feel good about working with us long after closing. Contact us to discuss your optionsm compare what you would profit from each option and decide what works best, given your current personal and financial situation. Call O&L Properties LLC at (682) 200-9276.